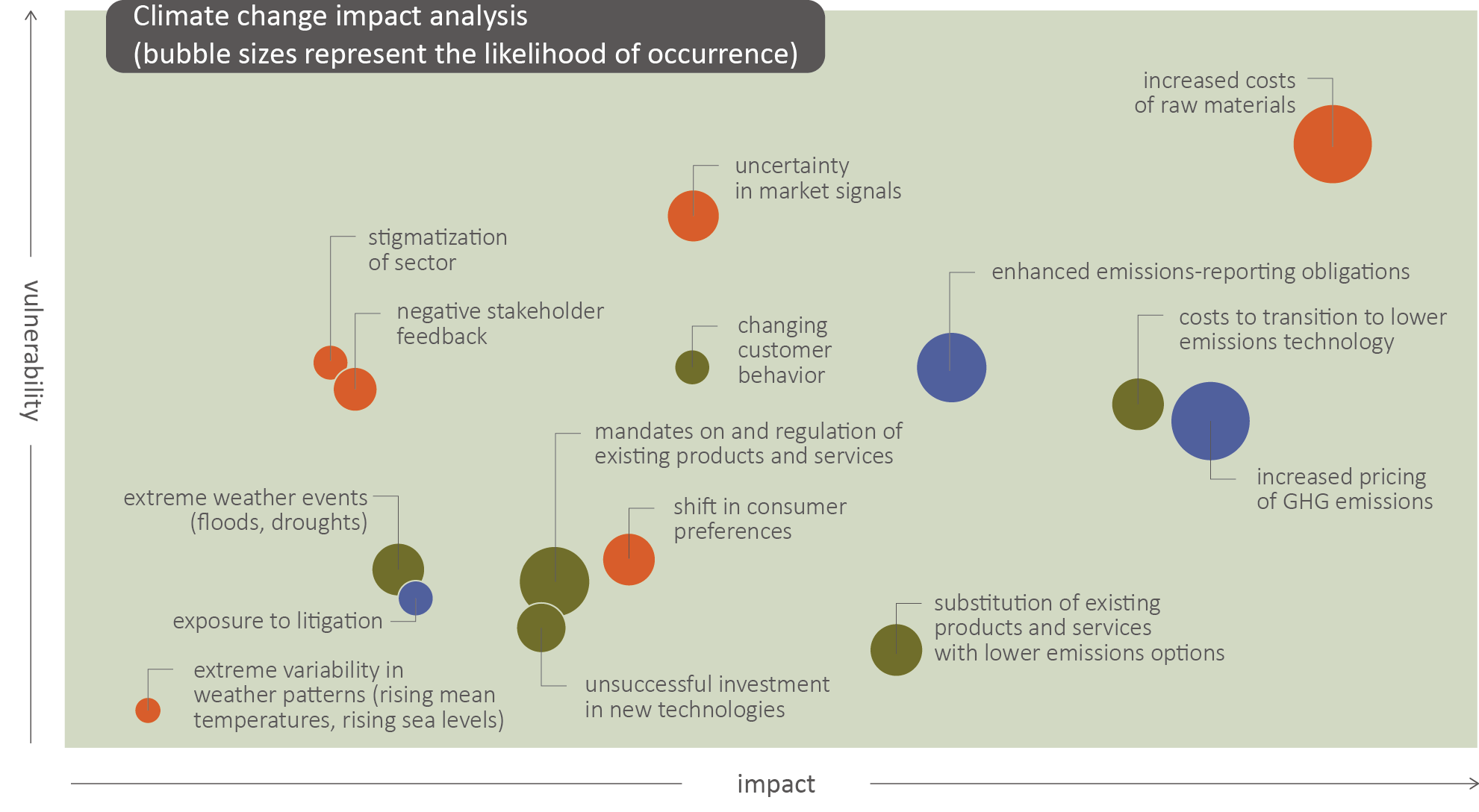

Risk assessment for climate change

By referring to the recommended content for climate-related financial disclosure, we have conducted a three-dimensional quantitative assessment of our potential vulnerabilities, impacts and the likelihood of occurrence for each risk before classifying and ranking the risks based on the results of the analysis, thereby allowing us to identify potential opportunities and how we ought to respond. In the 2021 climate-related risk identification, senior officers found that increased costs of raw materials, increased pricing of GHG emissions, costs to transition to lower emissions technology, enhanced emissions-reporting obligations, and uncertainty in market signals are the five major risks. In the 2022 climate-related risk identification, these risks persisted and no re-assessment was required.

Note: Vulnerability: YOKE’s preparedness or adaptability to this risk (along the X-axis, greater indicates lower preparedness and adaptability)

Impact: the degree of operational impact on YOKE when this risk occurs (along the Y-axis, greater indicates the higher impact on operation)

Probability: the likelihood of this risk occurring within ten years (the size of the bubble is directly proportional to the chance of occurrence)

After the 2021 climate-related risk assessment, we have focused our management efforts on five areas: strengthening supply chain management, efficient production and sales processes, developing new low-emission technologies, implementing carbon emissions inventory and disclosure, and continuing to pay attention to the market demand for carbon management, so as to enhance our climate change resilience.

strategies at the next level while striving for more extensive information disclosure that includes the potential financial impact that relevant risks and opportunities may have on our operation, revenues and expenditures.